Home » Services » Tax Compliance and Consulting » Indonesia Accounting & Tax Reporting Services

INDONESIA ACCOUNTING & TAX REPORTING SERVICES

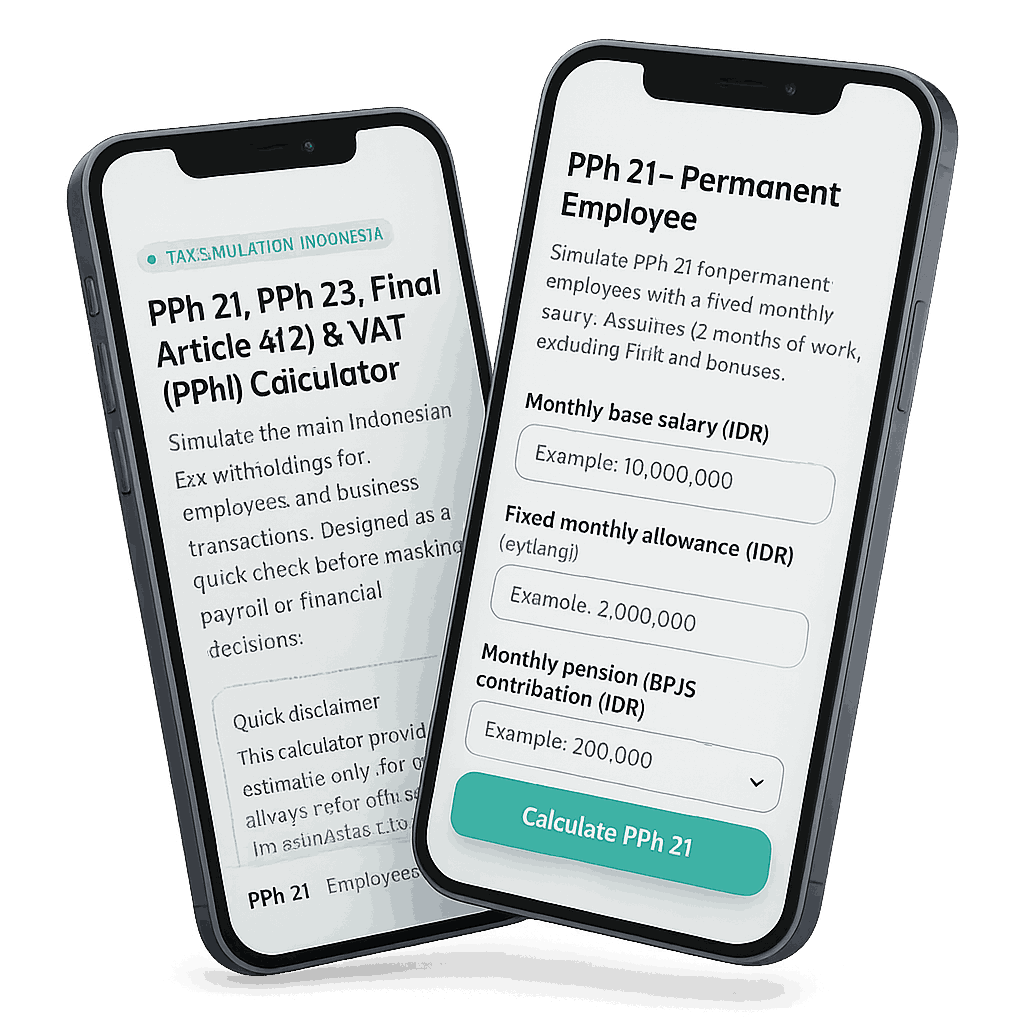

Our Indonesia accounting and tax reporting services are designed to help businesses meet legal obligations while ensuring precise financial records. From tax filings, bookkeeping, to financial reporting, our team of experts is here to keep your business in compliance with local regulations.