Indonesia’s ecommerce industry growth refers to the rapid expansion of B2C and mobile-first digital commerce across the country, making Indonesia the largest ecommerce market in Southeast Asia by transaction value. With a market size of approximately USD 75 billion in 2024 and projections reaching USD 94.5–104.2 billion in 2025, Indonesia has transitioned from an emerging market into a scaled, high-growth ecommerce economy. This ecommerce industry growth is driven by 278 million consumers, smartphone penetration above 70 percent, platform leaders such as Shopee, Tokopedia, and Lazada, and accelerating adoption in Tier 2 and Tier 3 cities.

For foreign investors and ecommerce operators, Indonesia offers large addressable demand, established digital infrastructure, and long-term revenue upside, provided market entry accounts for regulatory compliance, logistics execution, and localized consumer behavior.

Market Scale and Growth Trajectory of Indonesia’s Ecommerce Industry

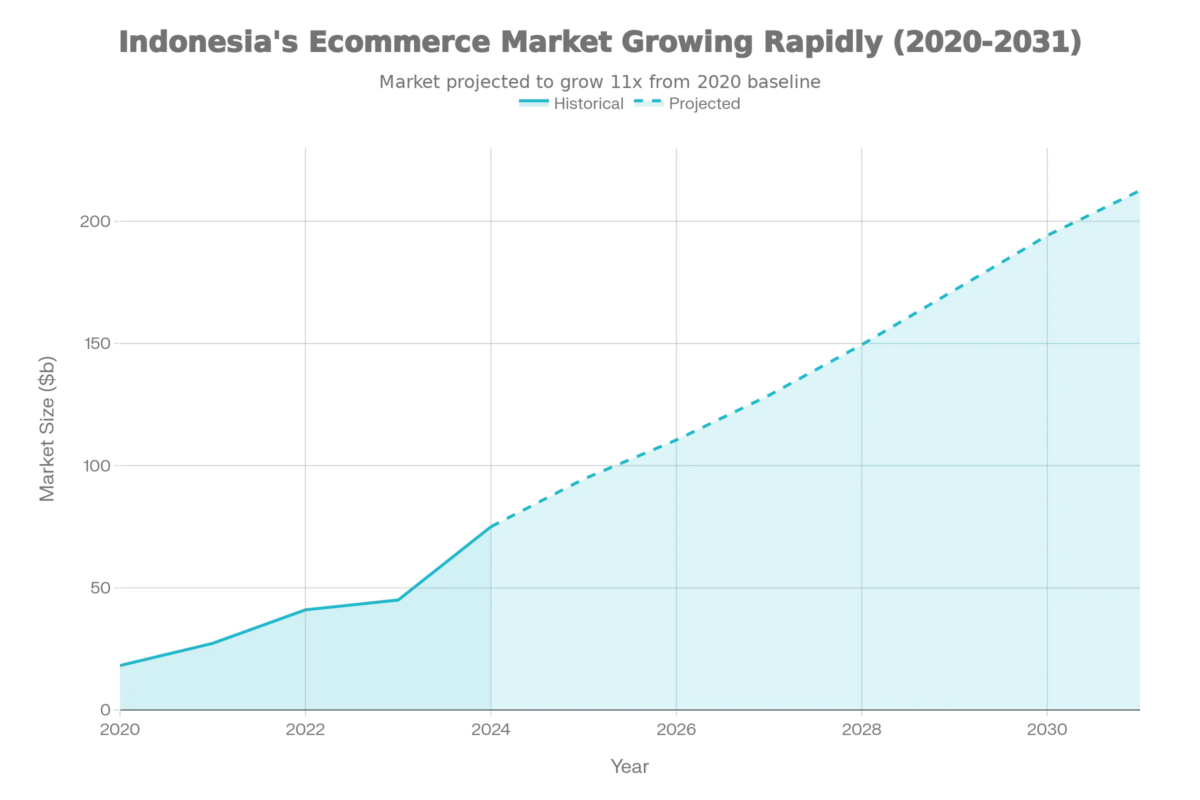

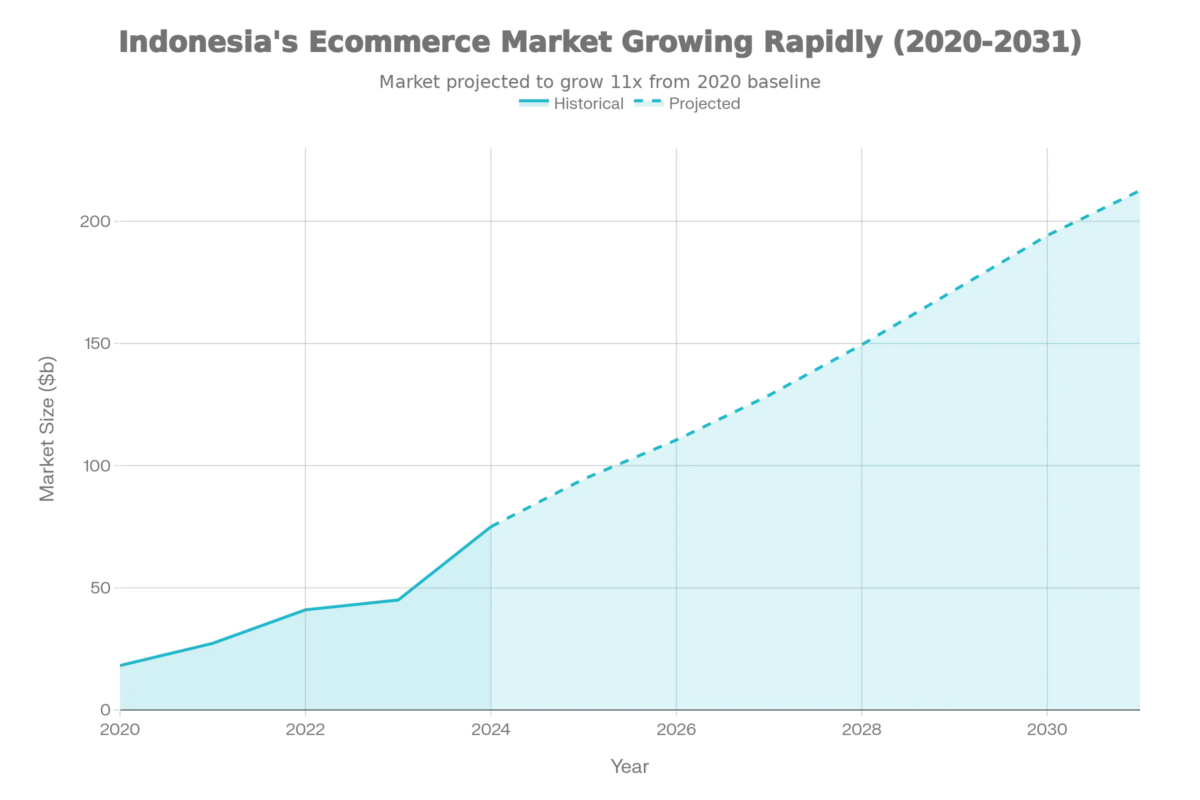

Indonesia is the largest ecommerce market in Southeast Asia by both transaction volume and gross merchandise value, accounting for more than half of total ASEAN ecommerce activity. In 2024, the market reached approximately USD 75 billion and is projected to grow to USD 94.5–104.2 billion in 2025. Medium- to long-term projections indicate continued expansion toward USD 160–194 billion by 2030, with some forecasts extending beyond USD 212 billion by 2031.

This growth trajectory is underpinned by several structural drivers rather than short-term demand spikes. Internet penetration has exceeded 70 percent, smartphone usage is approaching near-universal levels, and Indonesia’s population of 278 million continues to provide a demographic advantage unmatched by regional peers. One in five Indonesians now belongs to the middle class, supporting sustained growth in discretionary online spending. Government-led digitalization initiatives and improving digital infrastructure further reinforce ecommerce adoption among consumers and merchants alike.

Importantly, growth is not limited to major urban centers. Tier 2 and Tier 3 cities are increasingly contributing incremental demand as logistics networks expand and digital payment adoption deepens. This geographic diffusion of ecommerce activity reduces concentration risk and supports long-term market resilience.

Regional Comparison Within Southeast Asia

When compared with other Southeast Asian ecommerce markets, Indonesia stands out on three dimensions: absolute scale, growth durability, and market depth. While countries such as Thailand, Vietnam, and Malaysia have achieved high ecommerce penetration relative to population size, their total addressable markets remain structurally smaller due to demographic constraints.

Indonesia’s ecommerce market alone exceeds the combined ecommerce value of several ASEAN peers. Unlike smaller markets that are approaching saturation, Indonesia continues to expand through new consumer cohorts, geographic coverage beyond Java, and emerging verticals such as B2B ecommerce and social commerce. This creates a longer growth runway and more room for new entrants.

From an investor perspective, Indonesia also offers greater ecosystem maturity. The presence of large, well-capitalized platforms such as Shopee, Tokopedia, and Lazada has accelerated logistics development, payment infrastructure, and merchant onboarding at a national scale. While this concentration increases competitive intensity, it also lowers execution risk for new brands and foreign entrants by providing ready-made distribution, fulfillment, and payment rails.

In contrast, smaller ASEAN markets often require heavier upfront investment to build comparable infrastructure or rely on cross-border models with thinner margins. Indonesia’s combination of scale and ecosystem readiness makes it uniquely positioned as both a regional headquarters market and a primary revenue center for ecommerce operations in Southeast Asia.

Also read: Comparing Indonesia’s Foreign Business Entry Barriers vs. Other ASEAN Countries

Industry Structure and Market Leaders

Indonesia’s B2C ecommerce landscape is highly concentrated. Shopee, Tokopedia, and Lazada collectively control around 85 percent of market share. Shopee leads through aggressive logistics investment and merchant incentives. Tokopedia strengthened its position after merging with TikTok Shop, embedding social commerce directly into transactional flows. Lazada, while smaller, has reached operational profitability, signaling a more mature competitive phase.

However, this concentration does not eliminate opportunity. B2B ecommerce, vertical marketplaces, and direct-to-consumer brands continue to grow faster than the overall market. Platforms serving procurement, wholesale, beauty, fashion, and groceries demonstrate that specialization often outperforms generalization.

Also read: Top 10 Biggest E-commerce Companies in Indonesia

Social Commerce and Mobile-First Advantage

Indonesia is structurally mobile-first. Nearly 70 percent of ecommerce transactions already occur on smartphones, and that share continues to rise. This environment has accelerated social commerce and live shopping, where product discovery and conversion happen simultaneously.

Live shopping engagement rates in Indonesia are among the highest globally. Conversion rates can be three times higher than traditional product listings, driven by trust, real-time interaction, and influencer-led recommendations. For foreign brands, this shifts the go-to-market strategy from pure performance marketing toward community-driven and content-based commerce.

Payments, Fintech, and Consumer Behavior

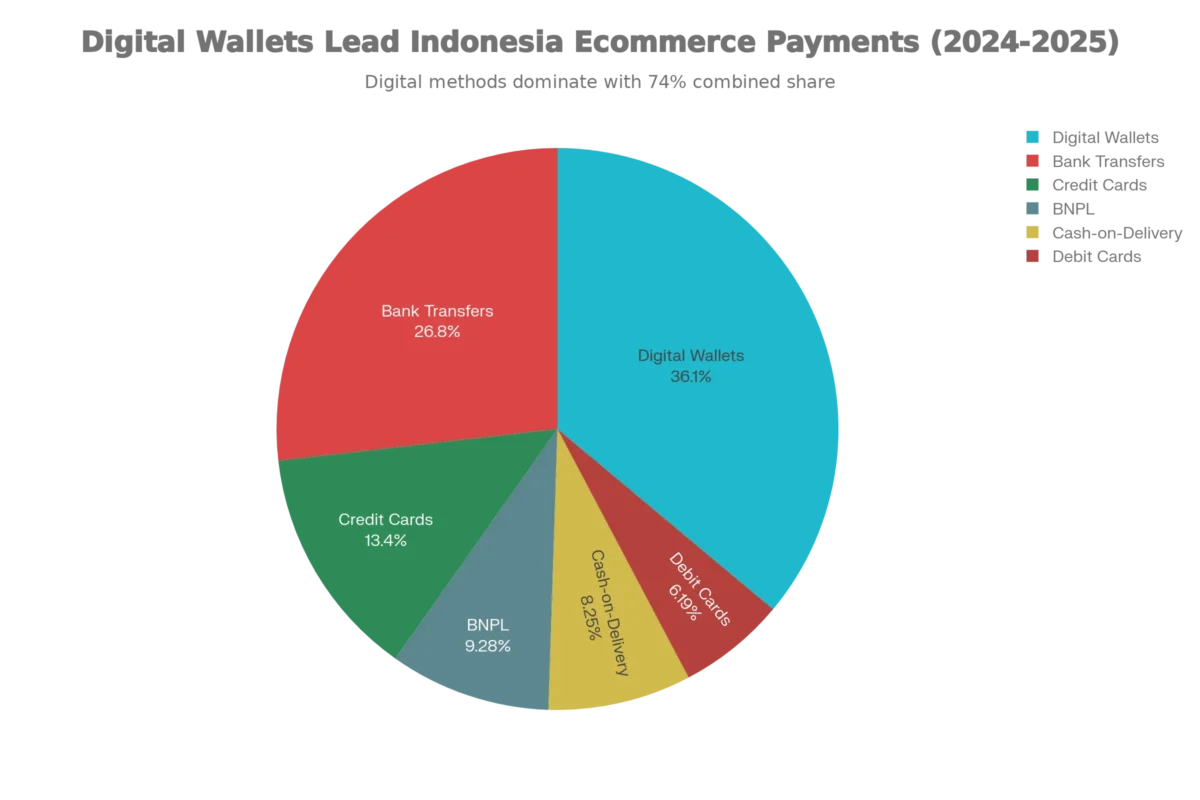

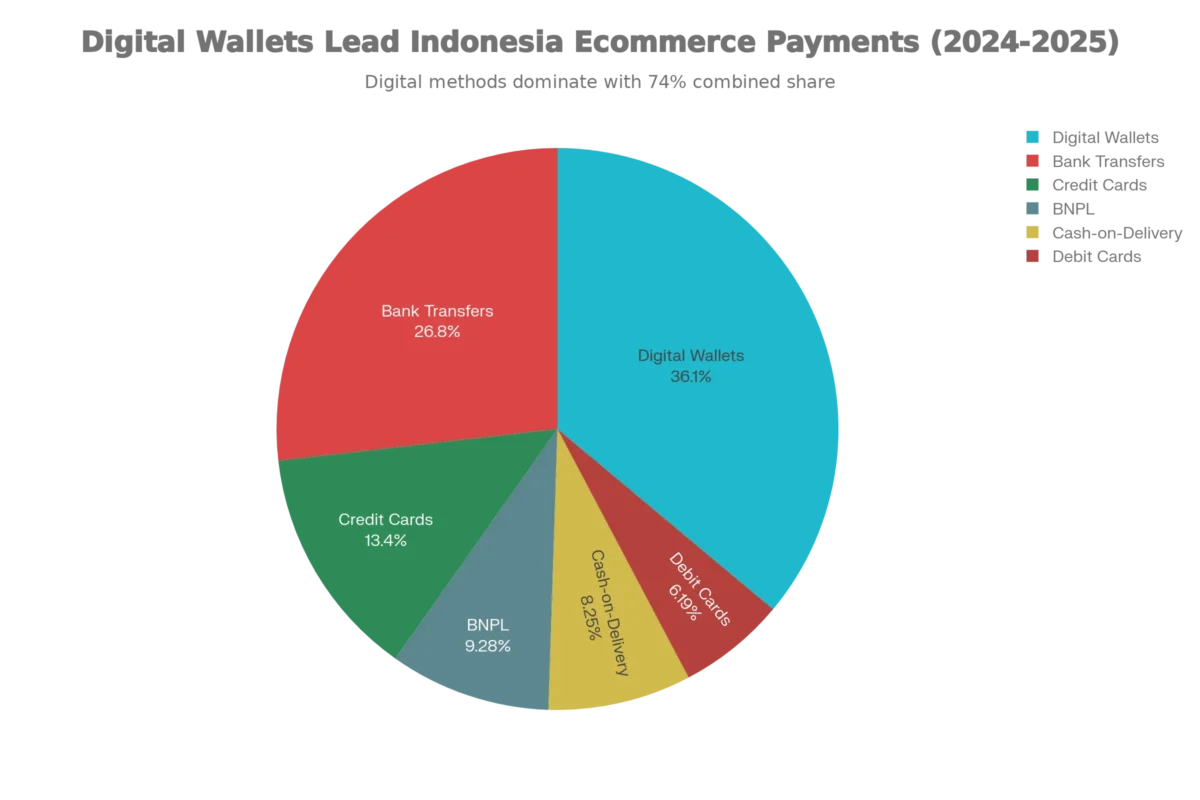

Digital wallets dominate ecommerce payments, led by GoPay, OVO, and DANA. Buy-now-pay-later adoption is growing rapidly, reshaping consumer purchasing behavior and increasing average order values. For ecommerce operators, integrating multiple payment gateways is no longer optional. It is a core conversion lever and a prerequisite for scale.

Regulatory Environment and Foreign Ownership

Indonesia allows 100 percent foreign ownership for ecommerce businesses through a PT PMA structure. However, the regulatory environment has become more sophisticated. Ecommerce operators must comply with trading licenses, data protection rules, electronic transaction laws, and evolving tax regulations.

From our experience, many foreign founders underestimate this complexity. Proper legal structuring, licensing through the OSS system, and early compliance planning are critical to avoid operational disruptions as the business scales.

This is the stage where InvestinAsia typically supports foreign investors through PT PMA registration service and ecommerce licensing, ensuring your business can operate legally, collect payments, and contract with platforms and logistics providers without structural risk.

Check: From Paperwork to Profit: How InvestinAsia Simplifies the PT PMA Incorporation Journey

Logistics as Both Constraint and Opportunity

Indonesia’s geography creates logistics challenges that directly affect unit economics. Last-mile delivery, inter-island shipping, and inventory placement require localized strategies. Successful ecommerce businesses adopt hybrid fulfillment models with regional hubs rather than relying on centralized warehouses.

For investors, logistics inefficiency also creates opportunity. Businesses that solve delivery speed, cost predictability, or cold-chain distribution often gain defensible advantages in specific categories.

How Foreigners Can Start an Ecommerce Business in Indonesia

A practical entry strategy usually follows three steps. First, establish a legal entity through a PT PMA. Second, validate demand through major marketplaces while building a branded ecommerce channel. Third, expand through social commerce and localized marketing.

Without legal business legitimacy, foreign-owned ecommerce operations face limitations in payment processing, platform partnerships, and tax compliance. This is why many investors eventually transition from informal arrangements to fully registered companies.

At the end of this journey, InvestinAsia’s complete Indonesia company registration services support foreign investors who are ready to formalize or expand their ecommerce operations, covering incorporation, licensing, and ongoing compliance under one integrated advisory framework.

If you are interested in starting an ecommerce business in Indonesia, you can start by contacting us for FREE consultation.

Frequently Asked Questions

Is Indonesia still a high-growth ecommerce market?

Yes. Despite its size, Indonesia continues to grow at double-digit rates due to demographic expansion, digital adoption outside major cities, and new formats such as social commerce and B2B ecommerce.

Can foreign investors fully own an ecommerce company in Indonesia?

Yes. Ecommerce businesses can be 100 percent foreign-owned through a PT PMA, subject to licensing and regulatory compliance.

Which ecommerce segments offer the best opportunities?

B2B ecommerce, social commerce, groceries, beauty, and category-specific vertical platforms currently offer the strongest growth potential.

What is the biggest challenge for ecommerce businesses in Indonesia?

Logistics complexity and regulatory compliance are the most common operational challenges, particularly for foreign-owned businesses.