NPWP (Nomor Pendaftaran Wajib Pajak) is Indonesia’s official taxpayer identification number issued by the Direktorat Jenderal Pajak for individuals and businesses that earn taxable income. This 15-digit registration number records tax obligations, verifies taxpayer status, and supports compliance across Indonesia’s income tax, VAT, and corporate tax systems. NPWP for tax reporting ensures accurate monitoring of transactions, facilitates access to public services, and acts as a mandatory credential for Indonesian citizens, foreign workers, and legal entities operating in the country.

What is NPWP (Nomor Pendaftaran Wajib Pajak) in Indonesia?

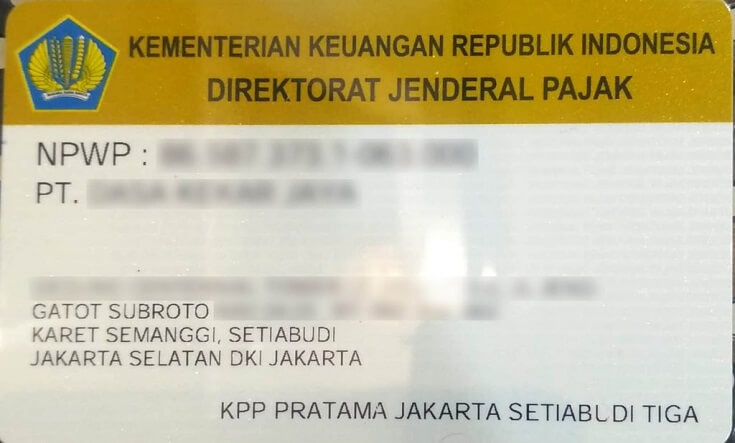

NPWP, commonly known as Taxpayer Identification Number, is a unique identification number issued by the Indonesian tax authority, Direktorat Jenderal Pajak (Directorate General of Taxes). It serves as a legal requirement for individuals and entities engaged in various taxable activities within the country.

NPWP consists of 15 alphanumeric characters and serves as an official recognition of your tax obligations in Indonesia. It helps the tax authorities to monitor and track your tax payments, ensuring compliance with the tax regulations.

Also read: 10 Essential Things About Business Culture in Indonesia

Who is required to register for NPWP?

The obligation to obtain NPWP in Indonesia varies depending on your individual circumstances. Generally, the following categories of individuals and entities are required to register for NPWP:

Indonesian Citizens

All Indonesian citizens aged 17 years or older are required to have an NPWP. It is mandatory for citizens who earn income, conduct business activities, or own assets subject to taxation.

Foreigners Residing in Indonesia

Non-Indonesian individuals residing in Indonesia, including expatriates and foreign workers, are also obligated to obtain NPWP if they receive income from Indonesian sources or engage in taxable activities within the country.

Legal Entities and Businesses

All legal entities, such as corporations, partnerships, and foundations, as well as self-employed individuals operating a business, are required to register for NPWP. This includes both domestic and foreign-owned entities operating in Indonesia.

Also read: 7 Reasons and Advantages for Starting a Business in Indonesia

How to Get NPWP in Indonesia?

The process of obtaining NPWP in Indonesia involves several steps. Here’s a simplified guide to help you through the process:

Prepare Required Documents

Gather the necessary documents, which typically include your identification card (KTP), passport, taxpayer identification card (Kartu Tanda Penduduk), and other supporting documents related to your income or business activities.

Read more about What is KTP (Kartu Tanda Penduduk) in Indonesia.

Complete the Application Form

Obtain the NPWP application form from the nearest Tax Office or download it from the official website of the Directorate General of Taxes. Fill in the form with relevant and accurate information.

Submit the Application

Visit the Tax Office in your area and submit the completed application form along with the required supporting documents. Ensure that all documents are valid and up to date.

Also read: What Is BPOM in Indonesia: Its Role and Regulation

Verification and Approval

The Tax Office will review your application and conduct necessary verifications. Once your application is approved, you will be issued an NPWP.

Receive your NPWP

You will receive your NPWP certificate and card, which will serve as your official tax identification.

Also read: Type of KITAS in Indonesia and It’s Requirements

That’s all about NPWP Indonesia meaning, requirements, and how to get one. It is important to note that the process and requirements may vary slightly depending on your specific circumstances and the Tax Office you visit. It is advisable to consult with a tax professional or utilize Indonesia Tax Services for accurate guidance tailored to your needs.

Obtaining NPWP (Nomor Pendaftaran Wajib Pajak) is a vital step for individuals and businesses operating in Indonesia. It serves as a unique identification number that establishes your tax obligations within the country. By understanding the meaning, purpose, and process of obtaining NPWP, you can ensure compliance with Indonesian tax regulations.

To ensure compliance and streamline the process, consider leveraging the expertise of Indonesia Tax Consultant and Compliance Services. At investinasia, we offer comprehensive tax consultation and assistance, helping you navigate NPWP registration, tax reporting, and other taxation matters seamlessly.