Laporan Kegiatan Penanaman Modal (LKPM) is Indonesia’s mandatory investment activity report required by the Investment Coordinating Board (BKPM) to track business development, capital realization, and operational progress. LKPM reporting for Indonesia functions as a compliance mechanism within the OSS-RBA system, ensuring transparency for projects in construction and commercial stages. Businesses submit LKPM with detailed data on investment value, workforce absorption, production output, and encountered obstacles, following the schedules set under Law No. 25 of 2007 and BKPM Regulation No. 5 of 2021.

Accurate LKPM reporting supports eligibility for investment facilities, strengthens supervision of foreign and domestic direct investment, and prevents administrative sanctions such as warnings or permit suspension.

What is LKPM in Indonesia?

Laporan Kegiatan Penanaman Modal (LKPM), or Investment Activity Report, is a mandatory requirement for every business entity in Indonesia as stipulated in Article 15(c) of Law No. 25 of 2007 on Investment, Article 5(c), and the BKPM Regulation No. 5 of 2021 concerning Guidelines and Procedures for Business Licensing Supervision Based on Risk.

Also read: What is BKPM Indonesia: It’s Role for Foreign Direct Investment

Legal Basis

- Law No. 25 of 2007 on Investment

- BKPM Regulation No. 7 of 2018 on Guidelines and Procedures for Investment Implementation Control

- BKPM Regulation No. 5 of 2021 on Guidelines and Procedures for Risk-Based Business Licensing Supervision

Is LKPM Reporting Mandatory?

Yes, according to BKPM Regulation No. 5 of 2021, business entities are obligated to create and submit an Investment Activity Report (LKPM) to the Investment Coordinating Board (BKPM). The LKPM can be submitted online through the Risk-Based OSS (Online Single Submission) system.

What Should Be Reported in LKPM?

The LKPM should include:

- The development of business activities, whether they are in the construction stage or have started commercial operations

- Realization of investment

- Realization of workforce

- Production realization including export values

- Partnership obligations and other related duties

Reporting Schedule

- Quarterly (every 3 months): January, April, July, and October, by the 10th of each respective month.

- Biannually (every 6 months) for small businesses with investments exceeding IDR 1 billion: July 10 for Semester I and January 10 for Semester II.

- For medium and large businesses with investments exceeding IDR 5 billion: Quarterly, by the 10th of April, July, October, and January.

Also read; Exploring the Types of Business Licenses in Indonesia

LKPM Reporting Procedures

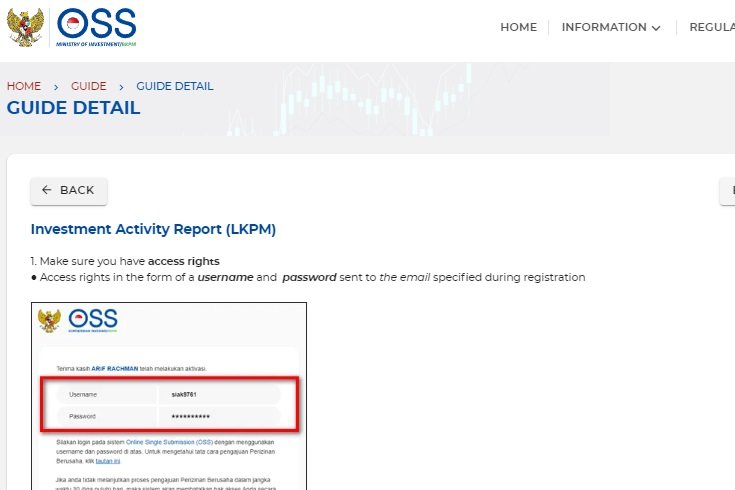

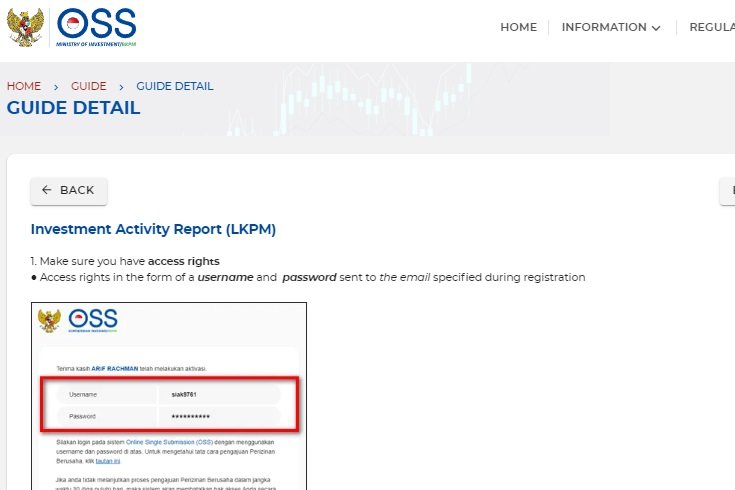

- Obtain access rights (username and password sent to the registered email).

- Visit oss.go.id and click “Login” in the top right corner.

- Input your username and password, then select “Login.”

- Select “Reporting” then “LKPM Report” and click “Reporting.”

- Choose “Create report” and pick the data to be reported.

- Fill in investment realization and workforce data.

- Complete the report by entering the problems faced by the business and the responsible officer’s details.

- Agree to the reporting declaration and click “Submit report.”

- Monitor the status of the report for verification.

Also read; Indonesia Tax Rate: An Updated Guide

How to Fill Out LKPM Online for Businesses in the Construction Stage (Not Yet Commercial)?

- Access lkpmonline.bkpm.go.id or oss.go.id and enter your user ID and access code.

- In the LKPM menu, select “Construction stage/Not yet commercial” and click “Add new LKPM.”

- Select the license to be reported and click “Next.”

- Enter the investment realization data according to the applicable regulations.

- Fill in the company contact details and the responsible officer’s data, then click “Submit LKPM.”

- Check the LKPM status in the “LKPM search” menu on the homepage.

How to Fill Out LKPM Online for Businesses in the Production Stage (Already Commercial)?

- Access lkpmonline.bkpm.go.id or oss.go.id and enter your user ID and access code.

- In the LKPM menu, select “Production stage/Already commercial” and click “Add new LKPM.”

- Select the license to be reported, submit the LKPM per project, and click “Next.”

- Enter the investment realization data according to the applicable regulations.

- Fill in the product/service realization and marketing data for the reporting period, then click “Next.”

- Fill in the company contact details and the responsible officer’s data, then click “Submit LKPM” and check the LKPM status on the homepage.

Also read: Indonesia Labour Law & Employment Regulations: Complete Guide

Administrative Sanctions for Not Reporting LKPM

Businesses that fail to submit the LKPM within the stipulated time frame will face administrative sanctions, which may include:

- Written or online warnings

- Restrictions on business activities

- Suspension of business activities and/or investment facilities

- Revocation of business activities and/or investment permits and facilities

Timely and accurate submission of LKPM is crucial for maintaining smooth business operations and avoiding administrative sanctions. Legalitas.org offers comprehensive legal services, including business establishment and necessary licensing, to ensure your business complies with all regulations. Contact our team for the best offers and support.

Also read: LKPM Reporting for PMA / Foreign Companies in Indonesia

Report LKPM Without the Hassle

LKPM reporting can be time-consuming. To simplify your LKPM reporting, you can rely on the LKPM Reporting Services from InvestinAsia. Our experienced legal team is ready to assist with your business reporting until completion.

Contact us now and get a special price!

FAQs about LKPM in Indonesia

What is the LKPM report?

The LKPM report is a periodic report on the realization of investment and issues faced by business entities, mandatory for submission to the Investment Coordinating Board (BKPM).

How often should LKPM be reported?

LKPM must be reported quarterly (every 3 months) for medium and large businesses and biannually (every 6 months) for small businesses with investments exceeding IDR 1 billion.

What should be included in the LKPM report?

The report should include investment realization, workforce data, production realization including export values, partnership obligations, and other related duties.

What happens if the LKPM report is submitted late?

Late submission can result in administrative sanctions such as written or online warnings, restrictions, suspension, or revocation of business activities and investment permits.

What is the purpose of LKPM?

The LKPM provides solutions to issues faced by businesses and serves as a reference for applying for investment facilities.

Who is required to submit LKPM?

All business entities, except micro businesses with investments below IDR 1 billion, upstream oil and gas companies, banks, non-bank financial institutions, and insurance companies.

source:

- nswi.bkpm.go.id/nswi_dev/lkpm

- investasi-perizinan.ntbprov.go.id

Article reviewed by:

Tax Consultant of InvestinAsia