The Indonesian government has officially implemented the CoreTax system as of January 2025. This initiative by the Directorate General of Taxes (DJP) aims to modernize tax administration through digital integration, improving efficiency, transparency, and compliance for taxpayers across the country.

Also read: Understanding Indonesia’s Tax Bracket System (Latest Update)

What is the CoreTax System?

CoreTax is Indonesia’s latest digital tax system designed to streamline tax administration. It enables taxpayers to fulfill their obligations online, from reporting tax returns (SPT) to making payments. By leveraging advanced information technology, CoreTax replaces manual processes, reducing errors and enhancing real-time tax data monitoring.

The system is part of the broader Tax Administration System Renewal Project (PSIAP), as outlined in Presidential Regulation No. 40 of 2018. It integrates core business processes such as taxpayer registration, tax filing, payments, audits, and collections into a single digital platform.

Also read: Withholding Tax in Indonesia: Complete Guide for Foreigners

Why is CoreTax Important?

CoreTax simplifies tax administration while promoting:

- Better compliance through automated tax reporting.

- Transparency with real-time data access.

- Efficiency by reducing paperwork and processing time.

- Integration with digital tax administration and taxpayer identification systems.

Also read: Indonesia Tax Rate for Foreigners: What You Need to Know

Key Changes Under CoreTax

With the implementation of CoreTax, taxpayers must be aware of the following major changes:

New Taxpayer Identification Number (NPWP) Format

CoreTax adopts a 16-digit NPWP format:

- Individual taxpayers now use their National Identity Number (NIK) as their NPWP.

- Businesses, government institutions, and foreign individuals with a previous 15-digit NPWP must add a “0” at the beginning.

Introduction of NITKU for Business Units

Branch offices no longer require separate NPWPs. Instead, they will receive a Nomor Identitas Tempat Kegiatan Usaha (NITKU), linking them to the parent entity’s NPWP.

Simplified Digital Access for Taxpayers

Previously, obtaining NPWP, electronic services, and a VAT-registered business account (PKP) required separate processes. CoreTax merges these into a single registration, enabling instant access to DJP’s digital services.

Easier Password Recovery

Taxpayers can reset their passwords online by entering their NPWP and registered email. This eliminates the need for an Electronic Filing Identification Number (EFIN) or visits to tax offices.

Self-Service Data Updates

Taxpayers can now update their contact details, addresses, and bank information online, facilitating faster tax refund processing without additional verification requests from DJP.

Also read: Progressive Tax in Indonesia: Complete Guide for Expats

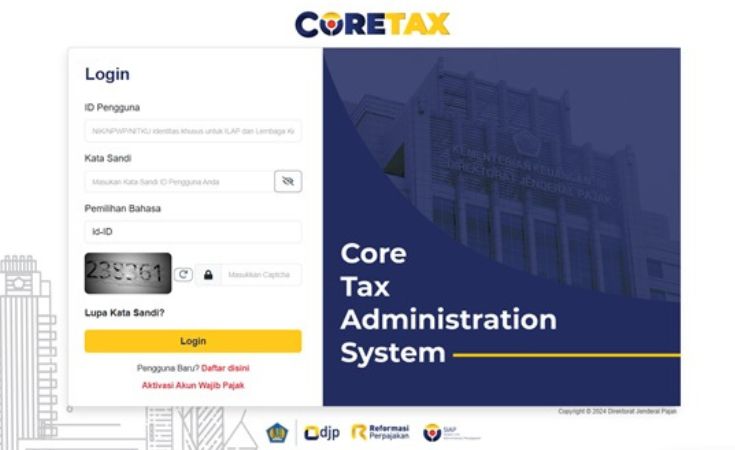

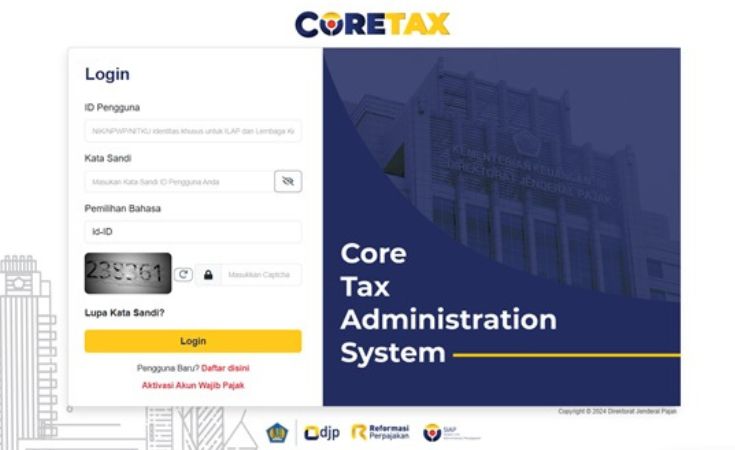

How to Activate a CoreTax Account

For registered taxpayers, activating a CoreTax account is straightforward:

- Visit coretaxdjp.pajak.go.id.

- Click “Forgot Password” on the login page.

- Enter your 16-digit NPWP (or NIK for individuals), registered email, and captcha code.

- Check your email for a password reset link.

- Create a new password and passphrase, then save the changes.

- Log in to download your updated NPWP and tax registration certificate (SKT).

Also read: Crypto Tax in Indonesia: Latest Update on the Regulation

Challenges and Ongoing Improvements

While CoreTax is a major leap forward, its implementation has faced initial challenges. The Indonesian Minister of Finance, Sri Mulyani Indrawati, acknowledged taxpayers’ concerns and assured that improvements are ongoing. The government is committed to refining the system to enhance user experience and efficiency.

CoreTax marks a significant milestone in Indonesia’s digital tax transformation. By integrating core tax processes into a unified online platform, it simplifies compliance, enhances transparency, and fosters a modern tax ecosystem.

Taxpayers, whether individuals or businesses, should take advantage of CoreTax to meet their obligations efficiently while supporting Indonesia’s evolving digital economy. For further details, visit the DJP’s official website or consult with InvestinAsia’s Indonesia tax consultant and compliance services.

Our experienced team of professionals is ready to assist you in every tax matter, such as:

- Accounting and tax reporting services in Indonesia

- Indonesia Payroll Service

- Indonesia LKPM Reporting Service

- Indonesia VAT Taxpayers Registration

Contact us now for FREE consultation and special package!

source: