Bonded Zones in Indonesia, officially known as Kawasan Berikat (KB), form one of the country’s most powerful fiscal instruments to promote exports and industrial growth. These zones allow companies to import, process, and store goods with major tax and customs exemptions before re-exporting or releasing them domestically. In essence, they act as both Industrial Assistance and Trade Facilitator, giving manufacturers faster supply chain cycles, improved cash flow, and global price competitiveness.

In this article, we at InvestinAsia will guide you through the complete geographical map of bonded zones in Indonesia, explaining their locations, focus industries, and economic significance. Understanding these zones will help you choose the right investment location aligned with your business goals.

Also read: Bonded Zone in Indonesia: A Complete Guide for Foreign Investors

Major Bonded Zone Clusters in Indonesia

Check the following table to find out which areas are included in the bonded zone in Indonesia.

| Region / Area | Main Cities or Industrial Parks | Focus Industries | Key Fiscal Benefits | Strategic Advantages |

|---|---|---|---|---|

| West Java | Cikarang, Bekasi, Karawang | Electronics, automotive, precision manufacturing | Import duty & VAT exemption | Proximity to ports, integrated logistics, skilled labor pool |

| Central Java | Semarang, Kudus, Surakarta | Textile, footwear, garments | Duty-free raw materials | Competitive labor cost, growing infrastructure |

| DKI Jakarta | Kawasan Berikat Nusantara (KBN) | Mixed industries, logistics, export processing | Tax suspension, warehousing flexibility | Near Tanjung Priok Port & Soekarno-Hatta Airport |

| Riau Islands | Batam, Bintan, Karimun | Electronics, shipbuilding, logistics | Full tax & customs relief | FTZ regime, close to Singapore & Malaysia |

| East Java | Gresik, Sidoarjo, Pasuruan | Machinery, food processing, chemicals | VAT and import tax exemption | Major port access, diverse supplier base |

| West Kalimantan | Ketapang, Mempawah | Mining, bauxite-alumina downstream | Tax-free import of machinery | Resource-based, linked with national downstreaming policy |

| South Sulawesi | Bone, Takalar, Luwu | Seaweed processing, agro-based | Non-VAT domestic linkage | Agro-export hub, access to maritime supply chains |

Regional Highlights

The following is a detailed explanation for each region that has bonded zones in Indonesia:

Java: The Manufacturing and High-Tech Core

Java is the primary industrial hub for Indonesia’s bonded zones, with dense clusters across Central, West, and East Java.

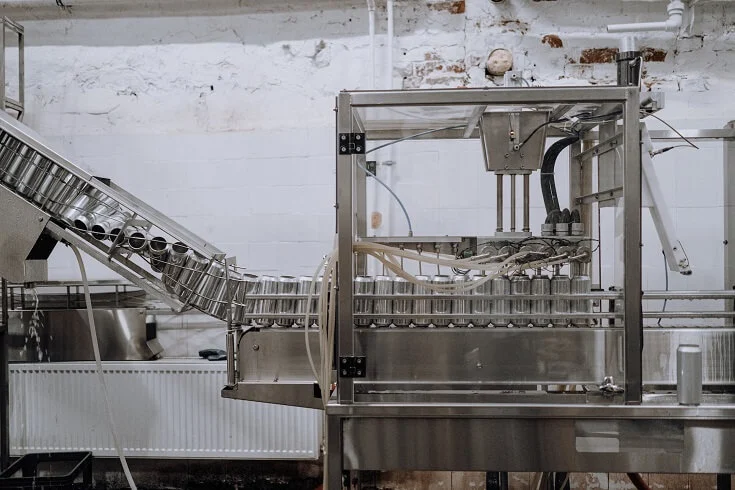

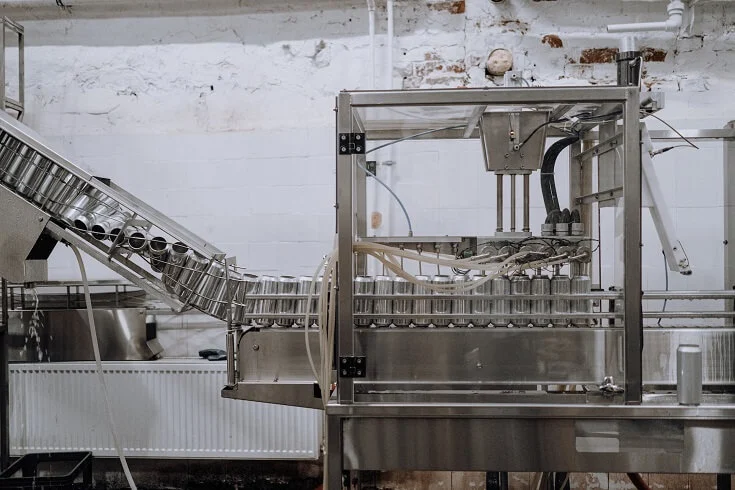

Central Java (Semarang, Kudus, Surakarta):

Known for labor-intensive manufacturing, particularly textiles, footwear, and garments. Customs offices in Semarang and Kudus supervise hundreds of bonded entities that rely on rapid processing of imported materials such as cotton and synthetic leather.

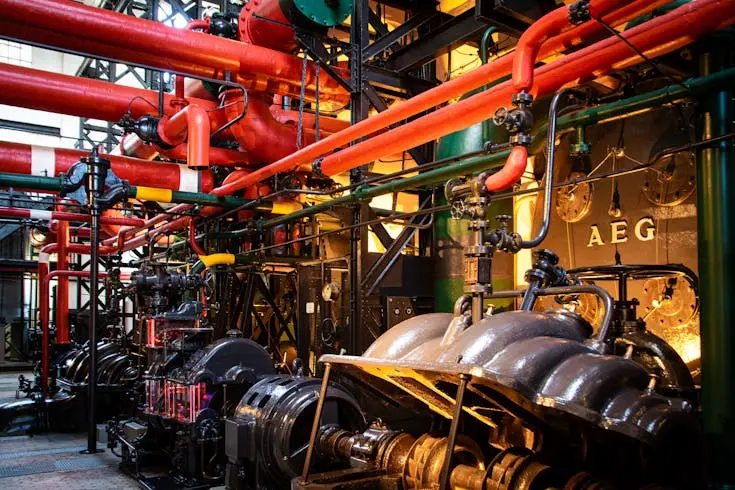

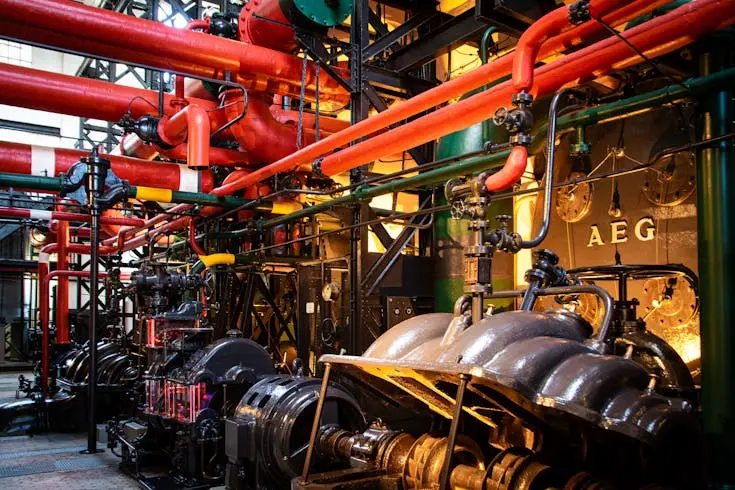

West Java (Cikarang, Bekasi):

Cikarang’s industrial corridor houses high-tech manufacturers like PT SOLUM Indonesia Hightech, producing electronic components (e.g., PCB assemblies) for export. Bonded status supports faster logistics and cost efficiency—crucial for tech industries operating under tight production schedules.

DKI Jakarta (Kawasan Berikat Nusantara – KBN):

Serving as an Export Processing Zone (EPZ), KBN combines manufacturing, logistics, and warehousing. Located near major ports and airports, it functions as the logistics and supply-chain hub of the Greater Jakarta area.

Riau Islands (Batam, Bintan, Karimun): The Special Regime Zone

The Batam–Bintan–Karimun (BBK) region operates under a special regime that evolved from bonded zones to Free Trade Zones (FTZs) and Special Economic Zones (SEZs).

Batam:

Focused on electronics, automotive, and solar panel manufacturing. Industrial parks like Batamindo and Kabil host export-oriented manufacturers with flexible customs procedures that cut production and delivery times.

Also read: Complete Requirements for Company Registration in Batam

Bintan & Karimun:

These islands complement Batam’s ecosystem with heavy industry and logistics facilities. Together, the BBK cluster is Indonesia’s gateway for high-tech exports and cross-border trade with Singapore and Malaysia.

Kalimantan: Downstream Processing and Resource-Based Industries

In West Kalimantan, bonded zones are integrated into resource downstreaming projects—key to Indonesia’s value-added policy.

The bauxite-to-alumina processing industry (e.g., PT KAN) is a prime example.

With over IDR 18 trillion invested, these bonded facilities enable cost-effective import of machinery and raw materials for smelting and refining.

This strategy not only diversifies Indonesia’s industrial base but also stimulates regional job creation and infrastructure development outside Java.

Sulawesi: Agromaritime and Commodity Export Hub

In South Sulawesi (Bone, Takalar, and Luwu), bonded zones support agro-based industries, particularly seaweed processing.

- Companies such as PT Biota Laut Ganggang benefit from bonded facilities that allow them to import machinery and export processed seaweed efficiently.

- The region’s bonded structure boosts Indonesia’s global competitiveness in the agromaritime sector, linking rural economies with global markets like the U.S., China, and Europe.

Why Bonded Zones Matter to Foreign Investors

For investors, Indonesia’s bonded zones provide a dual advantage: fiscal relief and logistical efficiency. They eliminate major import/export barriers, ensure just-in-time delivery, and minimize working capital requirements through tax deferment.

Moreover, bonded zones now serve a broader role—integrating local suppliers into export production chains. The non-collection of domestic VAT for subcontracting encourages large exporters to collaborate with local SMEs, strengthening Indonesia’s domestic supply chain resilience.

Strategic Recommendations for Investors

For investors who want to establish their business in a bonded zone, consider the following tips from InvestinAsia:

Choose the right cluster for your industry:

- Manufacturing and tech: West/Central Java

- Logistics and electronics: Riau Islands

- Resource processing: Kalimantan

- Agro and commodities: Sulawesi

Prioritize compliance and integrated IT systems:

Bonded facilities require strict reporting and tax compliance. Automated inventory systems linked with Customs are mandatory.

Leverage domestic linkages:

Use non-VAT subcontracting rules to build partnerships with local suppliers, improving efficiency and meeting Indonesia’s local content requirements (TKDN).

How We Can Help You Establish Your Business in Indonesia

At InvestinAsia, we specialize in helping foreign investors set up, expand, or relocate their business in Indonesia seamlessly and compliantly.

From selecting the right bonded zone to handling legal incorporation, taxation, and local partnerships, our team ensures you get an end-to-end solution designed for smooth market entry.

Learn more about InvestinAsia’s complete services:

- PMA registration in Indonesia (Foreign Company)

- Representative office registration in Indonesia

- Indonesia Local PT PMDN Set Up

- Indonesian Virtual office setup

- Business registration number in Indonesia

- Business Licenses in Indonesia

- Trademark Registration in Indonesia

- Franchise License in Indonesia

- Indonesia Visa and Stay Permits Application

- Indonesia Tax Consultant and Compliance

If you are interested in starting a business in Indonesia without hassle, you can start by contacting us for FREE consultation.

FAQs about Bonded Zones in Indonesia

What is the main purpose of a bonded zone in Indonesia?

To promote export-oriented industries by offering tax exemptions, import duty suspension, and logistical flexibility.

Are bonded zones only for large manufacturers?

No. SMEs involved in subcontracting or component supply can also benefit, especially under the non-VAT domestic linkage scheme.

Can foreign investors fully own bonded zone companies?

Yes. Many bonded entities are wholly or majority foreign-owned, provided they comply with Indonesia’s investment regulations.

Which bonded zone offers the best infrastructure for export industries?

Cikarang (West Java) and Batam (Riau Islands) are the most advanced, offering integrated logistics, industrial parks, and customs facilities.