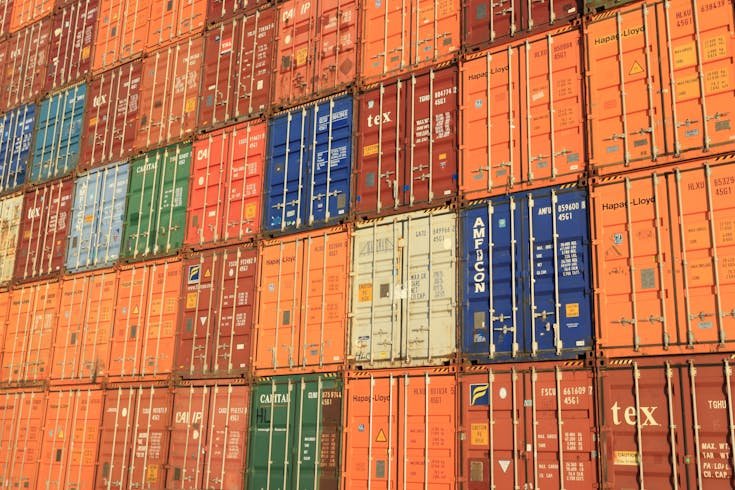

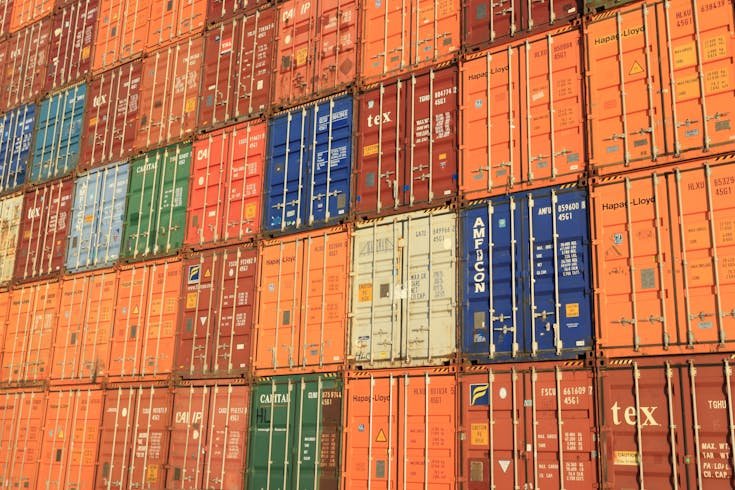

A Bonded Zone (Kawasan Berikat) in Indonesia is a designated customs area where imported and local goods receive special fiscal treatment to support export-oriented industries. Within these zones, goods are considered outside the customs territory, meaning import duties and taxes are deferred until the goods are sold domestically.

In essence, a bonded zone serves as a strategic facility to enhance Indonesia’s export competitiveness, promote industrial efficiency, and attract foreign investment.

Legal Framework and Strategic Purpose

Bonded Zones operate under Minister of Finance Regulation No. 65/PMK.04/2021, which updates the previous PMK 131/2018. The regulation ensures that customs and taxation facilities align with Indonesia’s modern industrial policy while strengthening digital compliance and supervision.

The main purpose of bonded zones is twofold:

- Macro-economic goals: boost exports, attract investment, and create jobs.

- Micro-industrial goals: provide fiscal efficiency and competitive pricing for manufacturers.

Through customs suspension and tax exemptions, bonded zones allow companies to maintain cash flow stability and faster logistics by eliminating physical inspections at ports.

Also read: What is the Richest State (Province) in Indonesia for Business?

Bonded Zones vs. Free Trade Zones

While often confused, Bonded Zones (Kawasan Berikat) and Free Trade Zones (Kawasan Perdagangan Bebas / KPBPB) differ significantly:

| Criteria | Bonded Zone (KB) | Free Trade Zone (KPBPB) |

|---|---|---|

| Customs Status | Within customs territory (fiscal suspension) | Outside customs territory (fiscal isolation) |

| Main Regulation | PMK 65/2021 | Law No. 36/2000 & PP 10/2012 |

| Main Focus | Manufacturing and export | Trade, logistics, and services |

| Tax Treatment | Deferred duties & VAT | Fully exempt within zone |

| Ideal For | Export manufacturing & subcontracting | Regional trade hubs |

Choosing between these depends on your business model. For manufacturing and export-oriented industries, a Bonded Zone offers superior cash flow management and tax deferral advantages.

Check the complete explanation: The Difference Between Bonded Zones and Free Trade Zones in Indonesia

Fiscal and Customs Facilities

Bonded Zones provide comprehensive fiscal incentives for both imported and local goods:

- Deferred Import Duty (Bea Masuk): Payment is postponed until goods enter the domestic market (TLDDP).

- Excise Exemption: Excise duties are waived for specific excisable goods.

- Import-Related Taxes (PDRI) Not Collected: Includes VAT, Income Tax (Article 22), and Luxury Goods Tax (PPnBM).

- VAT Exemption for Domestic Goods: Local inputs entering a bonded zone also enjoy VAT/PPnBM non-collection to support domestic supply chain integration.

For machinery and capital goods, importers enjoy long-term flexibility. After two years, these assets can be transferred or sold without paying the previously deferred import duties, incentivizing reinvestment and modernization.

Also read: How to Leverage Tax Incentives to Lower Investment Costs in Indonesia

Digital Compliance and Operational Governance

One of the most transformative aspects of Indonesia’s bonded zone system is mandatory IT Inventory Integration. Every Bonded Zone Operator (PDKB) must maintain a fully integrated, real-time digital inventory system connected to the Directorate General of Customs and Excise (DJBC).

This ensures transparency and efficiency by enabling:

- Online access for tax and customs authorities.

- Real-time risk analysis and audit capabilities.

- Reduced need for physical inspections.

Additionally, companies must implement CCTV monitoring and secure operational boundaries to ensure customs control integrity. Non-compliance with these requirements can lead to license suspension, reflecting Indonesia’s transition to risk-based, technology-driven supervision.

Subcontracting and Industrial Integration

The bonded zone framework also facilitates subcontracting arrangements, enabling collaboration between large exporters and domestic small-to-medium enterprises (SMEs).

- Subcontract Work: PDKB can send semi-finished goods or raw materials to local companies for processing.

- Machine Loans: Production tools and molds can be temporarily loaned to subcontractors.

This system deepens Indonesia’s industrial ecosystem and supports downstream (hilirisasi) development, especially in export-oriented sectors like electronics, automotive, and defense manufacturing.

Also read: Major Industries in Indonesia (Based on Contribution to GDP)

Performance Evaluation and Benefit-Cost Ratio (BCR)

Fiscal privileges in bonded zones are not unconditional. The government evaluates each participant using a Benefit-Cost Ratio (BCR) model to ensure national economic benefits outweigh fiscal costs.

- Costs: Fiscal incentives such as tax deferrals and exemptions.

- Benefits: Tax revenue contribution, employment, and investment value.

A BCR > 1 signifies that the company’s contribution to Indonesia’s economy justifies the continued provision of fiscal facilities. This model reinforces a performance-based incentive system, encouraging responsible and sustainable industrial participation.

Economic Impact and Key Statistics

Bonded Zones have become a cornerstone of Indonesia’s industrial policy.

As of November 2024, there are around 1,500 active bonded companies, collectively generating:

- Rp 3,140 trillion (US$ 32.5 billion) in foreign exchange earnings.

- 1.83 million jobs across multiple sectors.

- Rp 87.96 trillion in corporate income tax contribution.

These figures underline the pivotal role of bonded zones in Indonesia’s export-led growth and fiscal stability.

Strategic Recommendations for Investors

If you plan to establish or expand your business in Indonesia, Bonded Zones offer a strong foundation for export-oriented growth. However, success requires:

- Proactive compliance with IT and audit regulations.

- Demonstrated economic contribution (high BCR).

- Clear integration into Indonesia’s industrial ecosystem.

For foreign investors unfamiliar with Indonesia’s fiscal and legal environment, professional guidance is essential to select the most suitable structure—whether Bonded Zone (KB) or Free Trade Zone (KPBPB).

Also read: Where to Invest in Indonesia: 7 Best Cities and Locations

How InvestinAsia Can Help

At InvestinAsia, we specialize in helping foreign investors navigate Indonesia’s business landscape—from company registration to industrial licensing and tax structuring.

If you’re planning to set up or expand operations in Indonesia, our experts can guide you through compliance, site selection, and bonded zone registration.

Learn more about InvestinAsia’s complete services:

- PMA registration in Indonesia (Foreign Company)

- Representative office registration in Indonesia

- Indonesia Local PT PMDN Set Up

- Indonesian Virtual office setup

- Business registration number in Indonesia

- Business Licenses in Indonesia

- Trademark Registration in Indonesia

- Franchise License in Indonesia

- Indonesia Visa and Stay Permits Application

- Indonesia Tax Consultant and Compliance

If you are interested in starting a business in Indonesia without hassle, you can start by contacting us for FREE consultation.

FAQs about Bonded Zones in Indonesia

What is the main benefit of operating in a bonded zone?

Deferred import duties and taxes improve cash flow and enhance export competitiveness.

Are goods in bonded zones considered imported?

No. They are treated as outside the customs area until released to the domestic market.

Can local companies supply goods to bonded zones?

Yes. Domestic suppliers benefit from VAT exemptions when selling to bonded zone manufacturers.

What happens when finished goods are sold domestically?

Deferred duties and taxes become payable based on the product’s domestic sale price.

Is digital compliance mandatory for bonded zone operators?

Yes. All bonded companies must implement integrated IT inventory systems accessible by customs authorities.