In 2025, Indonesia is aligning tax policy with strategic economic goals, offering robust tax incentives across selected sectors to attract foreign investment, boost domestic productivity, and navigate the fiscal challenges posed by a VAT increase to 12%. These incentives are not only financial stimuli—they are tools for long-term transformation.

Also read: Why Indonesia Remains an Attractive Foreign Investment Destination in 2025

Strategic Sectors Targeted for 2025 Tax Incentives

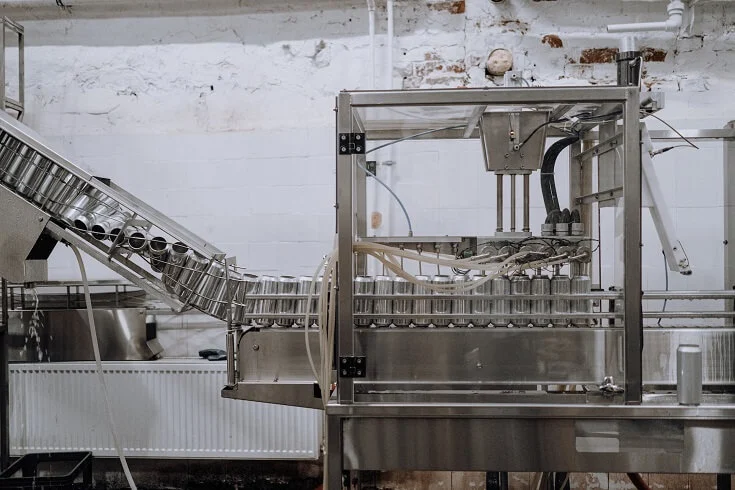

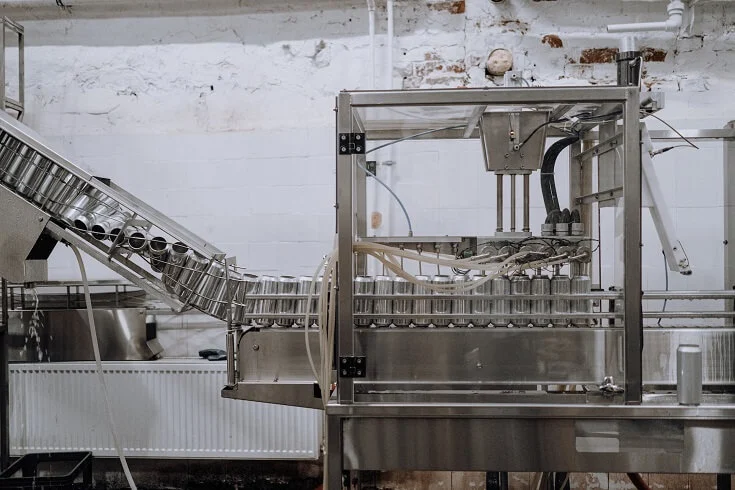

Manufacturing

A cornerstone of Indonesia’s industrial base, the manufacturing sector—especially small-scale and labor-intensive producers—is a prime beneficiary. Focus industries include:

- Textiles and footwear

- Furniture

- Processed food

- Automotive components

Key Benefits:

- Income tax relief for employees (PPh 21)

- Import duty exemptions on capital goods

- Preferential credit facilities (Rp20 trillion allocation)

Also read: Indonesia Manufacturing Industry: Outlook and Opportunities

Agriculture, Forestry & Plantation

Essential for ensuring food supply and supporting rural development, this sector receives incentives aimed at boosting modernization and enhancing global market competitiveness.

Key Benefits:

- Tax relief for sustainable farming tech

- VAT exemptions on equipment

- Subsidized financing for smallholder integration

Also read: Indonesia Agriculture Industry: Outlook and Potential

Financial Services & Insurance

To deepen financial inclusion and expand risk instruments for development sectors.

Key Benefits:

- Enhanced capital allowances

- Incentives for fintech innovation

- R&D tax benefits for insurtech platforms

Also read: Insurance Industry in Indonesia: Opportunities and Outlook

Transportation & Logistics

Indonesia’s archipelagic nature makes logistics a national priority. Tax incentives aim to reduce high distribution costs.

Key Benefits:

- Tax allowance for fleet and warehousing upgrades

- Import duty exemption for logistics infrastructure

- Incentives for green logistics systems

Education Services

A strategic push toward human capital development and knowledge economy transition.

Key Benefits:

- Tax deductions for training programs

- Super deductions for partnerships with local universities

- Reduced tax rates for vocational institutions

Green & Renewable Energy

While not always separately itemized in budget data, green projects (solar, hydro, waste-to-energy) are granted top-tier incentives.

Key Benefits:

- Tax holiday up to 15 years for >Rp5T investments

- Carbon market participation incentives

- Super deductions for R&D and tech transfer

Digital Economy & EV Ecosystem

Indonesia aims to lead Southeast Asia in digital infrastructure and EV production.

Key Benefits:

- 0% corporate tax for 5 years for data centers (>Rp1T)

- Tax breaks for BEV battery supply chains

- Exemptions from investment floor limits for tech startups in SEZs

Also read: Major Industries in Indonesia (Based on Contribution to GDP)

What Benefits Are Offered?

Tax Holiday (Up to 20 Years)

- Full exemption on corporate income tax

- Applies to pioneer sectors like green energy, EVs, and AI

- Based on investment size (min. Rp500 billion)

Also read; Tax Holiday in Indonesia: A Comprehensive Guide for Foreign Investors

Tax Allowance

- 30% tax deduction over six years

- Accelerated depreciation and loss carry forward

- Dividend tax reduction to 10%

Also read: Tax Allowance in Indonesia: A Key Investment Incentive

Super Deduction

- 300% for R&D

- 200% for vocational training

- Especially relevant for green tech and AI sectors

Import & VAT Exemptions

- Capital goods and raw materials for production

- Especially for businesses in Free Trade Zones or KEKs

Also read: Tax Incentives in Indonesia: Key Benefits and Opportunities

How to Qualify for These Incentives

General Requirements

- Operate in priority/pioneer sectors (as defined by BKPM and MoF)

- Must satisfy the minimum required investment value, typically ranging from Rp100 to Rp500 billion.

- Register as a legal Indonesian entity

- Apply via the Online Single Submission (OSS) system

Also read; How to Apply for Indonesia Investment Incentives via OSS

Documentation Checklist

- Business plan and financial forecast

- Company deed and tax ID (NPWP)

- Industry feasibility report (for pioneer sector verification)

- Proof of equity and debt structure

- Realization reports post-approval

Special Zones (KEK & IKN)

Companies in designated zones enjoy:

- Additional tax holidays (10–20 years)

- Extended land usage rights (up to 95 years)

- Customs and VAT exemptions

- Full foreign ownership (in select sectors)

Also read: How Foreign Investors Can Apply for Tax Allowance Incentives in Indonesia

Indonesia’s tax incentive strategy for 2025 is a blueprint for sector-led growth. By prioritizing manufacturing, renewable energy, digital economy, EV, and logistics, the government is stimulating investment where it matters most. Through a well-designed combination of fiscal relief, regulatory facilitation, and strategic zoning, investors gain a competitive edge—while Indonesia accelerates toward sustainable and inclusive development.

If you are considering starting a business in Indonesia, there are a number of resources and support services available to help you get started.

InvestinAsia is among the companies that specialize in aiding you with Indonesia company registration. We boast a team of seasoned experts who can guide you throughout the process of:

- Foreign company / PMA registration in Indonesia

- Indonesia representative office registration

- PT PMDN Set Up

- Virtual office setup in Indonesia

- Business registration number in Indonesia

- Indonesian Business Licenses

- Indonesia Trademark Registration

If you are interested in starting a business in Indonesia, you can start by contacting us for FREE consultation.

Furthermore, if you need assistance with tax issues in Indonesia, you can rely on our Indonesia Tax Consultant and Compliance Services for:

- Accounting and tax reporting services in Indonesia

- Indonesia Payroll Service

- Indonesia LKPM Reporting Service

- Indonesia VAT Taxpayers Registration

Contact us now for FREE consultation and special package!

Frequently Asked Questions (FAQs)

Which sectors qualify for the longest tax holiday?

Pioneer sectors like green energy, digital infrastructure, and EVs—especially for investments exceeding Rp30 trillion.

How do I apply for a tax incentive in Indonesia?

Register your business through the OSS system, submit detailed investment plans, and undergo BKPM and MoF evaluation.

Is there a tax benefit for R&D or vocational training?

Yes. Super deductions up to 300% for R&D and 200% for certified vocational training programs. Read the full guide her: Understanding Indonesia’s Super Deduction Tax for R&D and Training

What’s the benefit of investing in IKN or KEKs?

Enhanced incentives including extended tax holidays, land rights, and reduced regulatory barriers.